Regarding the energy security in the Black Sea, a critical period is the medium term 5-10 years, therefore it is important to analyze the dangers but also the opportunities for the countries in the region within this time frame. This period is important for several reasons: it is the crucial period for the beginning of the energy transition that will define the future in the net-zero world, Russia as a hydrocarbon-based energy power will be inclined to act in this time to ensure its benefits Before 2030, a medium-term vision is part of current plans and budgets.

Approaching green policies

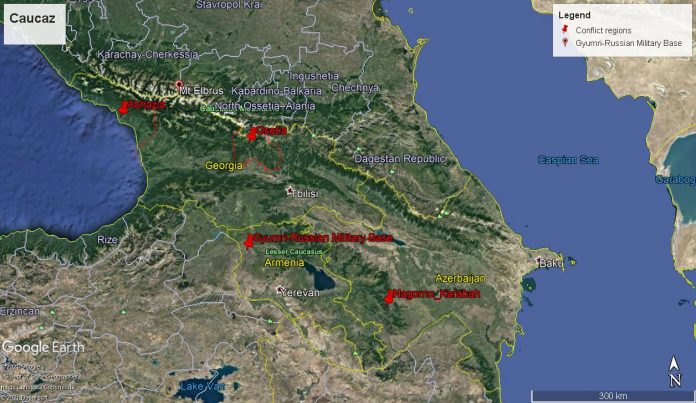

Countries that are in the EU (Romania and Bulgaria) will have to reduce carbon emissions by 55% by 2030. To achieve these targets but also due to the rising cost of carbon certificates both countries will have to reduce electricity production based on coal (representing in Romania 24% in Bulgaria 40% and in Ukraine 31.2%). As the question remains, what will replace coal? It can be renewable energy, nuclear or natural gas. Bulgaria has signed a memorandum of understanding with the US to build a nuclear power plant, Romania has signed a financing agreement with the United States for the 3.4 Cernavoda reactors. However, the new nuclear capabilities will not be ready sooner than 2028-2030. Romania and Bulgaria will increase their capacity from renewable sources by 2030 but are still below the level desired by the EU (Romania proposed 30%, Bulgaria 27% but the EU wants a share of 35% of electricity production). Another way to replace coal is to use natural gas as a transition fuel for a period of 5-10 years and then use it as we approach 2050. Bulgaria does not have enough natural gas resources, Black Sea explorations have not been successful, so they will have to rely on gas imports. Romania, on the other hand, has found gas resources in the Neptun Deep perimeter (42-80 billion cubic meters), but production will be able to start in the most optimistic scenario in 2027. At the same time, Romania’s gas production will decrease by 10% per year. and without trading in the Black Sea gas will become 40% dependent on gas imports by 2030. Although Ukraine is not a member of the European Union, it will also try to reduce carbon emissions to prove that it has a pro-Western orientation and that he is a responsible international actor. But without new nuclear power plant projects and a reduced growth of renewable energy sources, it will probably use gas to replace the energy produced with coal. Given that gas consumption has fallen steadily since 2014 due to economic problems, it is expected that with an economic recovery and gas consumption will increase. Ukraine is also facing a more problematic situation because, after the construction of the Nord Stream 2 gas pipeline, Russia will be able to stop gas supplies through Ukraine, which will deprive the country of transit taxes but will also make Russian gas imports much more expensive. To reduce these risks, Ukraine is already looking for foreign partners to try to increase its domestic gas production by signing memoranda of understanding with companies in Romania, Poland and Israel. Armenia with a nuclear power plant that has to be closed due to its age and seismic risks has no financial resources for serious investments in renewables and will probably also resort to Russian gas imports to meet its energy needs. The Armenian prime minister even called on Russia to build another nuclear power plant. Georgia has become a net importer of energy since 2019 and imports energy from Russia and Azerbaijan. One factor that will affect Georgia’s energy production is climate because the river’s flow will decrease, affecting Georgia’s hydropower. Given that in a net-zero scenario the need for electricity increases, Georgia will have to invest in renewable sources in order not to become dependent on electricity imports from Russia. Turkey is the most developed energy market in the region. Due to its dependence on Russian gas, it has adopted a policy of diversifying energy import sources and routes. Turkey has diversified its gas import sources (both pipelines and LPG), invested in solar, wind and hydro power, is building a nuclear power plant and recently declared a new gas discovery in the Black Sea that raises its oil deposits. gas at 540 billion cubic meters. Turkey has stated its intention to exploit the Black Sea gas commercially from 2023, but without foreign technology and expertise the year 2023 is very optimistic. At present, the Turkish state company TPAO is looking for external partners for the development of discovered deposits,