So-called rare earths are essential raw materials for a whole range of high technologies. For now, their extraction and, above all, their processing is almost exclusively in the hands of the Chinese. But Greenland, with its significant reserves, could reduce this dependence on the West.

Australian Greg Barnes is said to have given US President Trump the idea to buy Greenland in the summer of 2019. Although this part of the story is not really proven, it is known that entrepreneur and geologist Greg Barnes had a discussion with a number of experts. from the White House in July 2019 about what he had discovered in southern Greenland. And this was the discovery of rare metals at a level that could make the Danish Arctic island the “elephant in the room” for extracting such metals, as Barnes said enthusiastically. And this globally.

Shortly after the White House talks, Barnes accompanied US Ambassador to Denmark Carla Sands on a tour of the site where his Tanbreez company wants to exploit the metals. And the US geological authority USGS sent an entire delegation to study the site for about a month.

Aerial view of the Kringlerne massif in southern Greenland, where Australian mining company Tanbreez has discovered rich deposits of rare earth metals.

Hans Kristian Schonwandt / Reuters

Significant potential

The name Tanbreez describes what metals are found in that mine: tantalum (Ta), niobium (Nb), rare earth elements (REE) and zircon (Zr). Tantalum is in demand in many fields of microelectronics, and niobium in special steel alloys. Rare earth metals are used for a wide range of high-tech products, from environmentally friendly technologies to military applications. Zirconium, on the other hand, is found in nuclear power plants or alloyed with niobium as a superconducting material. In other words, areas that are of increasing importance in a future green and electrified economy or that have a special strategic value for the armaments industry.

Australian Greg Barnes

When Barnes says that the Kringlerne massif, located not far from the Greenland settlement of Narsaq, right in the south of the island, is one of the ten most important unexploited places for strategic raw materials in the world, we should think that there is also an important car component. -promotion – after all, he owns the prospecting rights with Tanbreez. But the fact that he has injected about $ 50 million of his own funds into his private company so far indicates that he believes in a bright future.

As for the potential, it’s certainly not entirely wrong. The production of about 3000 t of rare earth oxide is anticipated for the Kringlerne field, which would correspond to about 60% of Europe’s current annual demand.

When we compare the deposits even Kringlerne fades next to the Kvanefjeld massif, also not far from Narsaq, which is part of the same geological formation, the so-called Ilimaussaq intrusion. Kvanefjeld (or Kuannersuit in Inuit) could produce 25,000 tons of rare earth oxides per year, with world production currently at about 240,000 tons.

From the beginning of the Tanbreez project: Prospecting camp on a rock plateau (June 2010)

An Australian mining company is also responsible for the Kvanefjeld project, namely Greenland Minerals. But they encountered a major obstacle. In the recent elections for the Greenlandic parliament, two parties that wanted to thwart the project emerged victorious. The reason is that the ore in the Kvanefjeld massif, unlike Kringlerne, also contains radioactive elements uranium and thorium. As the mine is only a few kilometers away from the city of Narsaq and a considerable amount of ore waste would appear after the extraction of the rare earth concentrate, there are fears that this, as well as quarry dust, will create a major environmental problem. Despite the attraction of high foreign investment and a significant number of new jobs, the Kvanefjeld project met with widespread local opposition.

With or without China?

Tanbreez doesn’t have this problem. It is also on a different path. While Chinese company Shenghe Resources is a significant shareholder (with a 10% stake) and a strategic partner in Greenland Minerals, Greg Barnes would like to avoid China – a country that controls about 60% of the world market in rare earth extraction and concentrate processing. Separate metal ore is currently practically 100% controlled by China.

With this strategy, Tanbreez hopes to strike. China’s almost total dependence on China for products that are becoming increasingly important for various high-tech civilian and military fields is perceived as increasingly problematic by the US, EU, Japan and South Korea. And China is aware of the value of its position and is not afraid to use it as a lever in its international policy.

For example, in 2010, Beijing imposed export restrictions on Japan, which caused prices for rare earth products to explode. So China obviously puts its own needs and interests first, preferring to domestically produce and export high-quality goods (such as magnets) instead of semi-finished products. This is how Beijing, with its quasi-monopoly position, can influence the international market.

Under today’s conditions, China has the potential to use rare earths as a political tool, said Jesper Zeuthen, a professor of political science at Aalborg University, at a web event hosted by the Danish Institute for International Studies.

Pentagon concerns

The creation of its own rare earth mining chain from the mine to the final product has therefore become more urgent in Washington and Brussels. The US, for example, is concerned about the availability of critical raw materials for its high-tech weapons program. Even if it is only a fraction of the volume used in the electric car or wind turbine industry, for example, no one wants to risk not being able to access rare metals and especially high power like the United States.

That’s why the Pentagon is supporting both the recently reopened Mountain Pass in California, where a processing plant is to be built, and the Australian mining company Lynas, which plans to build a rare earth refinery in Texas.

Outdoor operation of the American Mountain Pass in California. Temporarily closed at the turn of the century, operations there have since resumed.

Steve Marcus / Reuters

Samples of rare earth metal products from the US Mountain Pass.

David Becker / Reuters

As far as Europe is concerned, Per Kalvig from the Geological Institute for Denmark and Greenland (GEUS) sees the problem in the relatively limited demand for rare earth metals. In order for it to be worthwhile to take the processing into your own hands, certain volumes and secure sales opportunities are decisive criteria. It is about a wide range of industries. The area of magnets, however important it may be, is not enough on its own.

As for Europe, Per Kalvig of the Geological Survey for Denmark and Greenland (GEUS) sees a problem in the relatively limited demand for rare earth metals. In order to deserve to take over the processing in your own hands, certain volumes and certain sales contracts are decisive criteria. It is about a wide range of industries. The magnet production industry, no matter how important, is not enough to ensure a single profit from the exploitation of rare earths.

The challenge of the West

Rare earth processing is difficult and expensive because it is so complex. Each mine provides a concentrate in a different composition, which requires individualized separation processes. Much of these capabilities are now concentrated in China and should be rebuilt elsewhere. This is also the logic behind the connection between Greenland Minerals and Shenghe Resources, a company with extensive experience and excellent contacts in this field. If, on the other hand, competitor Tanbreez focuses on the US and the EU, this makes sense and is understandable from a geostrategic perspective. But the structures for this must be established first.

The bottleneck for the West in the exploitation of rare earth metals is not the availability of raw materials themselves, but their processing into semi-finished products for industrial use.

In fact, according to a conservative estimate from the US Geological Survey 2019, the global reserves known for the rare earth concentrate amount to about 120 million tons. Even if annual global consumption is expected to double to about 500,000 tonnes, it would be enough for more than 200 years, says Danish geologist Kalvig. In other words, this means that the international market does not necessarily need to implement each of the fifteen mining projects that are currently being launched outside China to meet demand.

If the trend in Greenlandic politics returns to the Kvanefjeld project in a few years, it may be too late for this mammoth project as the market moves to oversupply. At Tanbreez, on the other hand, things look better. Since September last year, Greg Barnes already had a mining license in his pocket. For him, it is now crucial that the value chain outside China, on which his strategy is based, also emerges.

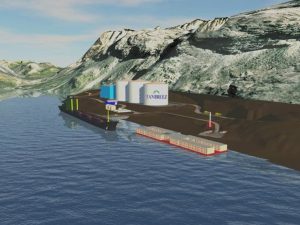

Simulation of the port and facilities for the initial ore processing of the Tanbreez project in South Greenland.